Estimate your annual taxes

See how Hong Kong stacks up against your home country.

In Hong Kong, personal tax is often referred to salary tax. This article provides you with an overview of the salary tax system in Hong Kong, Hong Kong tax rate and Hong Kong income tax. You will learn about the salary tax rate, salary tax allowance and allowable deductions for employees, tax benefits for employers and requirements of filing tax returns.

Both corporate and personal tax rates of Hong Kong are considered as one of the lowest in the world. Find out more about Hong Kong salary tax below.

Unlike flat corporate tax rate, Hong Kong’s salary tax rates follow a progressive tax rate system. There are five marginal tax brackets of 2%, 6%, 10% and 14% and 17%.

The key features of Hong Kong’s salary tax are as follows:

#Until superseded.

Note: To estimate your Hong Kong personal income tax, please refer to Hong Kong Tax Calculator.

Read more about the company formation in Hong Kong, Hong Kong income tax and Hong Kong tax rate.

See how Hong Kong stacks up against your home country.

For guidance purposes, the approximate exchange rate for Hong Kong dollar is 1 USD = 7.8 HKD.

A person’s income from employment, less allowable deductions, charitable donations and personal allowances, is chargeable to salaries tax at the following progressive rates: (Year of Assessment 2018/19 onwards#)

| Net Chargeable Income (in HKD currency) | Rate |

| 0– 50,000 HKD | 2% |

| 50,001– 100,000 HKD | 6% |

| 100,001– 150,000 HKD | 10% |

| 150,001– 200,000 HKD | 14% |

| Above 200,001 HKD | 17% |

| Net total income (no allowances) | Standard rate 15% |

#Until superseded.

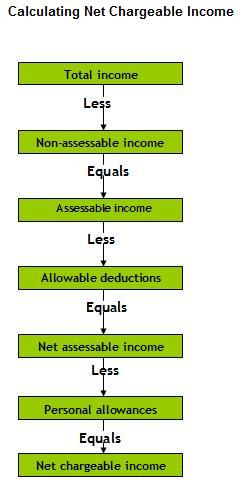

Net chargeable income or income subject to taxation is determined as follows:

The maximum tax payable is, however, limited to tax at the standard rate of 15% on the person's income from employment less allowable deductions and charitable donations, but without a deduction for personal allowances.

Net Chargeable Income = Income – Deductions – Allowances

Please, note that the basic allowance applicable to all tax payers in Hong Kong is 132,000 HKD (2018/19 onwards#).

Whereas total income includes:

Non-assessable income includes:

Allowable deductions and allowances include:

Deductions allowable under Salaries Tax and Personal Assessment:

| Expenses of Self-Education | 100,000 HKD |

| Elderly Residential Care Expenses | 100,000 HKD |

| Home Loan Interest | 100,000 HKD |

| Mandatory Contribution to Recognized Retirement Schemes | 18,000 HKD |

| Approved Charitable Donations [(Income - Allowable Expenses - Depreciation Allowances) x Percentage] | 35% |

Personal allowances include:

|

Basic allowance |

132,000 HKD |

| Married Person 's Allowance | 264,000 HKD |

| Child Allowance (For each of the 1st to 9th child) | 120,000 HKD |

| For each child born during the year, the Child Allowance will be increased by | 120,000 HKD |

| Dependent Parent and Dependent Grandparent Allowance (For each dependant) (1) Parent / grandparent aged 60 or above or is eligible to claim an allowance under the Government’s Disability Allowance Scheme (2) Parent / grandparent aged 55 or above but below 60 | (1) 50,000 HKD (2) 25,000 HKD |

| Additional Dependent Parent and Dependent Grandparent Allowance (1) Parent / grandparent aged 60 or above or is eligible to claim an allowance under the Government’s Disability Allowance Scheme (2) Parent / grandparent aged 55 or above but below 60 | (1) 50,000 HKD (2) 25,000 HKD |

| Single Parent Allowance | 132,000 HKD |

| Personal Disability Allowance | 75,000 HKD |

| Disabled Dependant Allowance (For each dependant) | 75,000 HKD |

Depending on your company’s needs, Hawksford can work with you as your bookkeeper, accountant, controller or a business advisor.

Hong Kong salaries tax is imposed on all employment income arising in or derived from Hong Kong. In other words, if your source of employment is in Hong Kong, i.e. you are employed by a Hong Kong company to work in Hong Kong; your full income is chargeable to salaries tax.

However, you can claim full or partial exemption of income or tax relief, under the following circumstances on a year-by-year basis:

If your source of employment is outside Hong Kong, i.e. you are employed by an overseas company but are assigned to work in Hong Kong for a few years by your overseas employer; you are only assessed on the income attributable to the services you render in Hong Kong.

Most gains and profits derived by you in respect of your employment are taxable.

The gains or profits include benefits, whether in money or otherwise, paid or granted to you in respect of employment. Some common examples of taxable benefits include:

Note that some of the non-cash benefits are taxed using special formulas. Further details on this are outside the scope of this guide.

Read more on Hong Kong Visas for employees and Hong Kong tax rate.

Capital gains refer to investment income that arises in relation to stocks, bonds or real estate. Hong Kong does not impose any capital gains tax.

Inheritance tax or estate duty is a tax on the total market value of a person’s assets (cash and non-liquid assets) at the time of his/her death. Estate Duty in Hong Kong has been abolished since February 2006.

Every taxpayer has to file annual tax returns with the Inland Revenue Department (IRD).

The year of assessment runs from April 1 through March 31 of the following year. IRD sends out individual tax returns by May 1. Tax returns normally have to be submitted within one month from the date of issue.

Note that even if you do not have any income to report, you still need to declare zero income in your tax form.

A married couple can elect to receive a joint assessment, if the single assessment based on their combined income results in a lesser tax liability.

With effect from 1 April 2019, 3 supplementary forms to Tax Return, being part of the return, should be filed together with the return.

If you are a sole-proprietor of a business, you can file the returns within 3 months from the date of issue. You can choose to file your returns online or by postal mail. After you have filed your returns, you will receive your ‘Notice of Assessment’ or tax bill from the Inland Revenue Department. The tax bill will indicate the amount of tax you are liable to pay for the given year of assessment. It will also state the provisional salaries tax payable for the succeeding year of assessment.

If you disagree with the tax bill, you need to inform the tax department within 30 days from the issue date of your tax bill and state your reasons for objection. Notwithstanding any notice of objection lodged by you, tax must be paid on or before the due date specified in the notice of assessment.

The Commissioner of Inland Revenue may impose penalties or issue an estimated assessment if there is a delay in filing the return.

A well-regulated yet simple tax system and low personal income tax rates have increased Hong Kong’s competitiveness in the region and it remains an attractive relocation destination for foreign professionals.

Moreover, unlike many western nations, Hong Kong has no capital gains tax – a policy that encourages investment by citizens and foreigners alike.

Depending on your company's needs, Hawksford can work with you as your bookkeeper, accountant, controller or a business advisor.

Get a quote now on the cost of Hong Kong employment visas from Hawksford. It's easy and quick. Let us help you get established in Hong Kong.

Discover how Hawksford can helpBack to top