Need support with your corporate taxes?

Hawksford can partner with you as your bookkeeper, accountant, controller, business advisor, part-time CFO — or your entire Accounting and Finance department.

Corporate tax (also commonly known as profits tax in Hong Kong) is calculated on a company’s assessable profits. The assessable profits are calculated by making various adjustments to the company’s net profit and loss accounts for the taxable period.

This is a general guide on various factors that should be taken into account when determining the taxable income of Hong Kong companies. For more information on corporate taxes in Hong Kong, please refer to Income Tax Guide for Hong Kong Companies. To estimate your Hong Kong taxes and to compare those with your home country, refer to our Hong Kong Tax Calculator.

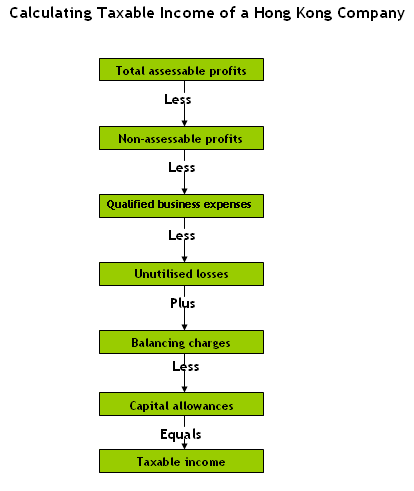

A company’s profits tax liability is calculated by making certain adjustments to its net profit and loss data as shown in the following flowchart.

Under Hong Kong law, a company’s net income includes:

The following adjustments are made to the company’s net income in order to arrive at the taxable income.

Profits of non-assessable nature are deducted from the company’s net income. Non-assessable profits include:

Expenses that are incurred in the production of business income are deductible. Examples of deductible expenses include:

Non-deductible expenses include:

Losses incurred can either be deducted from the company’s income in the same assessment year or carried forward and deducted from income in subsequent assessment years. To be deductible, losses must have arisen from carrying of a business in Hong Kong.

Note that an adjustment factor applies when unabsorbed losses incurred from concessionary trading receipts (trading receipts that are subject to a concessionary rate of tax) are set off against normal trading receipts (trading receipts that are subject to a normal rate of tax) and vice versa.

A balancing charge arises when the sale proceeds of a capital asset (i.e. building, structure, plant or machinery) exceeds its Written Down Value (cost of the asset minus the amount of capital allowances previously claimed).

Per Hong Kong law, depreciation of a fixed capital asset and expenditure incurred on the purchase of fixed assets are not deductible for tax purposes. Instead, tax relief in the form of capital allowances is available for initial capital expenditure and annual depreciation for wear and tear. Capital allowances are available for business premises and for plant and machinery used in the production of profits. The various types of capital allowances are as follows:

Once the above listed deductions and additions have been made, the company’s taxable income is obtained. The appropriate tax rate is applied to this income to determine the profits tax. The normalprofits tax rate for corporations stands at 16.5% on assessable profits and the tax rate for unincorporated businesses stands at 15% on assessable profits.

Hawksford can partner with you as your bookkeeper, accountant, controller, business advisor, part-time CFO — or your entire Accounting and Finance department.

Depending on your company’s needs, Hawksford can work with you as your bookkeeper, accountant, comptroller or a business advisor.

Find out how to take the burden out of tax and accountingBack to top